Original: Highstar Sodium

November 11, 2025, 19:06

The winter power crisis is transforming from an occasional risk into a business norm, testing enterprises’ survival and competitiveness. In 2024, over 50% of North American grids faced shortages in extreme cold; China’s winter load hit a record 1451 GW; Europe saw “Dunkelflaute” events driving electricity price surges. Manufacturing losses from a single five-hour blackout can wipe out years of effort, reshaping the global energy competition landscape.

01 Winter Power Crisis: The Triple Pressures Enterprises Face

Pressure One: Surge in Peak Loads — Grid Imbalance from Heating, Data Centers, EVs, and Green Energy Transition

Winter heating spikes demand, compounded by data centers, industrial heat pumps, and EV charging. Fossil fuel phase-out outpaces renewables, stretching grids to the limit. Over the next decade, North America’s winter peak demand will rise by 91 GW globally.

| Pressure Factor | Key Drivers | Impact on Grid |

| Heating Demand | Extreme cold weather | +30-50% load spike |

| Emerging Loads | Data centers, EVs, heat pumps | +20 GW annual growth |

| Energy Transition | Fossil fuel phase-out | Supply gaps up to 91 GW/decade |

Pressure Two: Exponential Blackout Costs — One Incident Can Erase Annual Profits

A 12-hour blackout in 2023 cost a precision manufacturer $2.4M (15% of annual profit), including production halts, fines, and repairs. Costs escalate with supply chain ripples.

| Loss Category | Estimated Cost (Single 12-Hour Incident) | % of Annual Profit Impact |

| Production Shutdown | $1.2M | 8% |

| Customer Penalties | $0.6M | 4% |

| Supply Chain Disruptions | $0.5M | 3% |

| Equipment Recovery | $0.1M | 0.5% |

| Total | $2.4M | 15% |

Pressure Three: Extreme Weather as the New Normal — Traditional Models Failing

Blizzards, ice storms, and cold snaps are routine: 80% of North American outages in 2024 were weather-related, not technical. Historical grid redundancy can’t keep up.

| Outage Cause | Frequency (2024) | Regional Example |

| Extreme Weather | 80% | North America blizzards |

| Technical Failures | 20% | Europe transmission issues |

| Other (e.g., Demand Surge) | <5% | China peak load records |

Energy Storage: From Passive Dependence to Active Energy Independence

Enterprises must shift from grid reliance to self-sufficiency. Energy storage upgrades “backup power” to a strategic asset, enabling energy resilience against blackouts. This evolution turns power users into independents, ensuring production continuity.

| Path Choice | Description | Outcome |

| Passive (Grid-Dependent) | Wait for outages, absorb losses | High risk, catastrophic costs |

| Active (Storage-Enabled) | Build self-controlled energy systems | Resilience, cost savings |

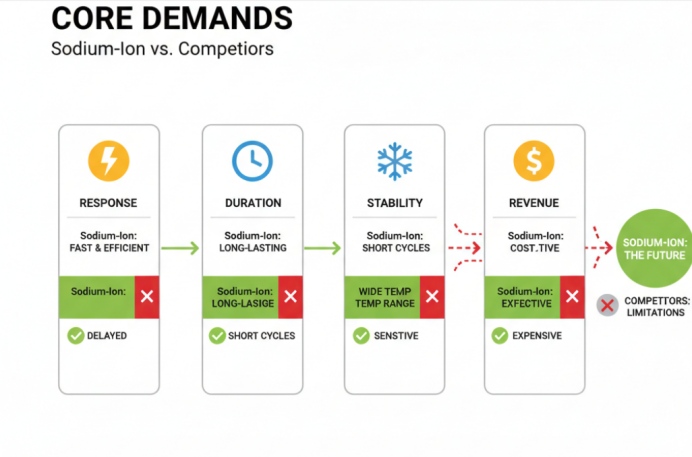

Demand 1: Ultra-Fast Response and Zero Interruption

• Millisecond-level power switching speed ensures factory production lines do not halt due to outages

• Comparison: Generators require 5-30 seconds to start; traditional UPS supports only minute-level emergencies; lithium-ion batteries can achieve 50-100 ms but may face response delays due to overheating risks

• Practical Significance: In outage events, the first 10 milliseconds often determine if critical equipment remains operational

- Highstar Sodium Technical Advantage: Its industrial-grade sodium-ion energy storage system features an intelligent switching module that completes power takeover in 20 milliseconds, ensuring “zero-perception” transitions for production lines. The rapid response characteristics of sodium-ion batteries enable millisecond-level switching under extreme conditions, far surpassing traditional technologies and the potential thermal runaway risks of lithium-ion batteries, providing more reliable zero-interruption protection.*

Demand 2: Long-Duration Coverage and Common Scenario Adaptation

• 4-8 hours of continuous discharge capability, covering most winter outage scenarios (average outage duration 2-4 hours)

• Comparison: UPS systems typically support only 30 minutes – 2 hours; generators can run long-term but require fuel replenishment; lithium-ion batteries experience 20-30% efficiency drops in winter due to temperature effects

• Practical Significance: Handles most sudden outages without manual intervention

- Highstar Sodium Technical Advantage: Modular design allows flexible scaling from 2 MWh to 100 MWh as needed, meeting demands from small to medium factories to large industrial parks. The inherent stability of sodium-ion batteries excels in extreme low temperatures with minimal performance degradation, ensuring reliable long-duration coverage—superior to the capacity losses of lithium-ion batteries in cold environments.*

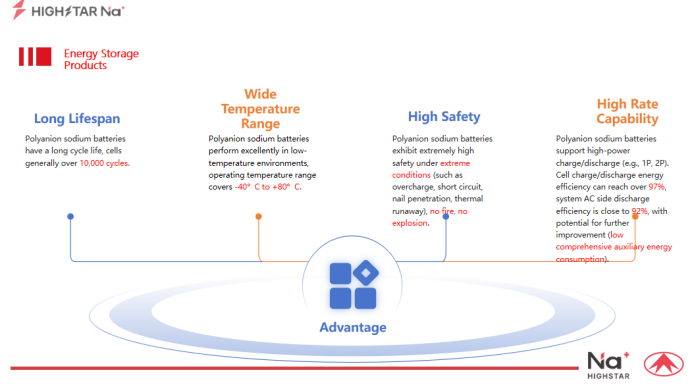

Demand 3: Decade-Level Stability and Extreme Environmental Adaptability

• Sodium-ion batteries > 9,000 full charge-discharge cycles, corresponding to a 10-15 year stable operation period

• Operating temperature range: -40°C to 60°C, with <3% performance degradation in extreme winter cold, leading industry stability

• Comparison: Lead-acid batteries last 3-5 years; lithium-ion batteries 2,000-5,000 cycles, lifespan 5-8 years; 30-50% performance drop in low temperatures

• Practical Significance: Sodium-ion remains reliable in extreme winter conditions; investment payback period is clear

- Highstar Sodium Technical Advantage: Equipped with intelligent thermal management and low-temperature preheating systems, real-world tests show >95% discharge efficiency at -40°C—designed specifically for high-latitude harsh cold regions. The non-flammable chemical properties of sodium-ion batteries further enhance safety and environmental friendliness, with cycle life 2-4 times that of lithium-ion batteries, reducing replacement frequency and pollution.*

Demand 4: Intelligent Energy Management and Multiple Revenue Models

• Not just emergency—also participates in grid scheduling and market trading

◦ Peak-Valley Arbitrage (charge in off-peak, discharge in peak)

◦ Capacity Market Revenue (government compensation for storage availability)

◦ Demand Response Programs (grid peak scheduling discharge for fees)

• Comparison: Backup generators can only standby without revenue; lithium-ion batteries support revenue models but are limited by high costs (resource scarcity causes price volatility) and safety risks for large-scale use

• Practical Significance: Energy storage systems generate income, accelerating investment recovery

- Highstar Sodium Technical Advantage: Proprietary EnergyOS platform automates peak-valley arbitrage and demand response, enabling businesses to achieve “passive earnings.” The cost efficiency of sodium-ion batteries (70% lower than lithium-ion batteries, thanks to abundant sodium resources) maximizes returns from these models, while avoiding lithium-ion supply chain risks and thermal management complexity.*

We Help You Overcome the Challenges.

Core Demands Comparison Table

| Core Demand | Sodium-ion Batteries (Highstar Sodium) | Lithium-ion Batteries | Traditional Alternatives (e.g., Generators/UPS) |

| Ultra-Fast Response | 20 ms switching; zero interruption in extremes | 50-100 ms; overheating risks delay response | 5-30 sec startup; limited to minutes |

| Long-Duration Coverage | 4-8 hours; <3% degradation in -40°C | 20-30% efficiency drop in cold; 2-4 hours max | Fuel-dependent; 30 min-2 hours without refuel |

| Stability & Lifespan | >9,000 cycles; 10-15 years; -40°C to 60°C range | 2,000-5,000 cycles; 5-8 years; 30-50% cold loss | 3-5 years (lead-acid); noise/fuel issues |

| Revenue & Management | Automated arbitrage/response; 70% cost savings | High costs/volatility limit scalability | No revenue potential; manual operation only |

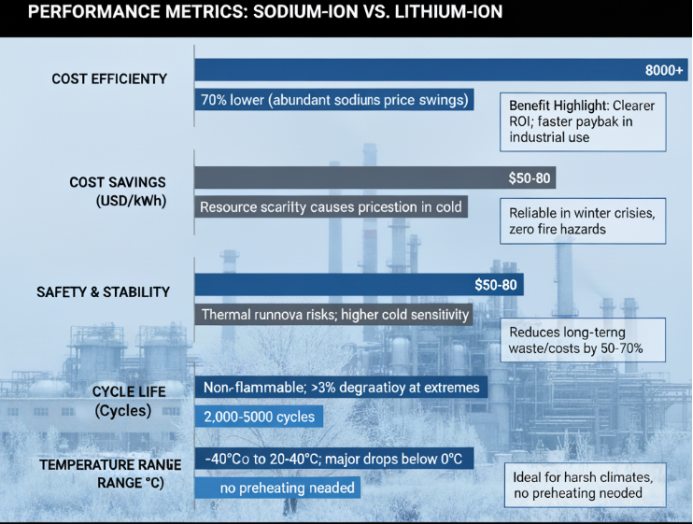

Performance Metrics Table (Sodium-ion vs. Lithium-ion)

| Metric | Sodium-ion Advantage | Lithium-ion Limitation | Benefit Highlight |

| Cost Efficiency | 70% lower (abundant sodium resources) | Resource scarcity causes price swings | Clearer ROI; faster payback in industrial use |

| Safety & Stability | Non-flammable; <3% degradation in cold | Thermal runaway risks; higher cold sensitivity | Reliable in winter crises; zero fire hazards |

| Cycle Life | >9,000 cycles (2-4x longer) | 2,000-5,000 cycles | Reduces long-term waste/costs by 50-70% |

| Temperature Range | -40°C to 60°C; >95% efficiency at extremes | Optimal at 20-40°C; major drops below 0°C | Ideal for harsh climates; no preheating needed |

Conclusion: Sodium-ion Storage is No Longer Just “Backup.” It’s Becoming the Foundation of Industrial Energy—like Water or Network Systems in Factories. Highstar Sodium’s All-Scenario Solutions Are a Key Pillar in Building This Foundation.

02 Real Case: How 10 MWh Sodium-Ion Storage Helped Manufacturing Survive Winter Risks

Enterprise Background

A global high-end precision manufacturer with $820 million annual output, producing industrial automation equipment. Power reliability is critical—one outage means halted lines, delayed orders, and lost clients.

Crisis Faced: After a 12-hour outage in 2023 caused $2.4 million in direct losses, the company realized grid dependency is no longer viable.

Deployment Decision

In early 2024, the enterprise installed a Highstar Sodium 10 MWh industrial-grade system:

• Capacity: 10 MWh (sodium-ion)

• Power: 2.5 MW, 4-hour discharge duration

• Investment: $3.1 million (leveraging sodium-ion‘s 40% cost advantage over lithium)

• Implementation: 3 months for design, procurement, installation, and grid connection

Operational Results (2024 Winter, 4 Months Actual Data)

| Revenue Source | Actual Results | Explanation |

| Emergency Protection | 2 outages → 0 downtime, 0 losses; avoided $5.76M hit | 2 sudden outages (45 min, 2h 15min) fully handled by Highstar Sodium system; lines ran continuously |

| Peak-Valley Arbitrage | $2.38M | Charged in valleys ($0.48-0.50/kWh), discharged in peaks ($1.10-1.50/kWh); 340 MWh arbitraged over 4 months |

| Capacity Market Revenue | $0.833M | Participated in government capacity market; priced at 2.5 MW × winter 4 months |

| Demand Response Scheduling | $0.672M | Responded to 15 grid peak-shaving calls; $20-50K fee per event |

| Winter 4-Month Total | $9.645M | – |

| Annualized Conservative Estimate | $7.68-8.13M | Accounting for seasonal variations; conservative figure |

Financial Returns

• Payback Period: 3.8-4.2 years (faster due to sodium-ion‘s lower upfront costs)

• Internal Rate of Return (IRR): 22.5%

• 10-Year Cumulative Benefits: $8,200M+

• Key Outcome: 100% elimination of winter outage risks; supply chain reliability boosted

What does this mean? The enterprise not only avoided catastrophic risks but turned Highstar Sodium storage into a profit center via market operations. Storage evolved from cost to revenue driver.

03 Why Now is the Critical Window?

If storage was once “optional,” it’s now “essential.” Four factors point to this:

- Sodium-Ion Costs Break Through Critical Point — TCO Enters Optimal Range

Over the past five years, sodium battery costs dropped 75%+. In 2025, mainstream sodium-ion system integration costs $250-350/kWh.

Impact: A 10 MWh system drops from $5M (lithium equivalent) to $3M. Payback shortens from 10+ years to 3-5 years—from “long bet” to “smart investment.” Sodium‘s abundant resources ensure sustained affordability. - Policy and Market Incentives Accelerate — Storage Shifts from Subsidies to Self-Sustaining Markets

Global economies back storage:

• US: Inflation Reduction Act offers 30% investment tax credits

• EU: Classifies storage as critical infrastructure with grid priority

• China: “14th Five-Year Plan” deploys 50 GW/100 GWh storage with 20-30% deployment subsidies

• Plus: Mature capacity markets and demand response enable more revenue streams

Impact: Early adopters get subsidies and market edges; latecomers face subsidy fades and saturation. - Power Market Liberalization and Volatility Amplify — Peak-Valley Arbitrage Opportunities Unprecedented

Traditional grids had 20-30% peak-valley spreads. With renewables rising, winter differentials hit 200-300% ($0.48/kWh low, $1.45/kWh high).

Impact: Storage arbitrage goes from “profitable” to “highly lucrative.” Early deployers gain a “power arbitrage machine” at low cost.

Highstar Sodium Technical Advantage: EnergyOS platform monitors real-time prices and automates charge-discharge, boosting arbitrage yields 20-25% via sodium-ion‘s rapid response. - Grid Reserve Capacity Continues to Shrink — No Alternative Path

As renewables grow and traditional plants retire, reserves contract. NERC data: North American winter margins drop further over three years. Outage risks rise, not fade.

Highstar Sodium Value Proposition: Don’t bet on “maybe no outage”—build “absolute no-outage” resilience with Highstar Sodium systems, leveraging sodium-ion‘s cold-weather superiority.

Conclusion: Now is history’s lowest-cost, highest-yield, most policy-friendly, and urgent moment for deployment. Missing this window means higher costs, fiercer competition, and greater outage risks.

04 The Era of Energy Self-Sufficiency Has Begun

The future belongs to factories with stable, controllable, profitable energy systems. These enable:

• Higher delivery reliability commitments (power no longer bottlenecks)

• Lower energy costs (arbitrage, market revenues)

• Stronger supply chain credit (outage risks eliminated)

• Aggressive expansion without power constraints

In this energy resilience revolution, Highstar Sodium‘s mission is clear—we don’t just provide storage; we help enterprises build an energy independence foundation.

From small industrial parks to large manufacturing bases, single factories to cross-regional coordination, we transform businesses from “power dependents” to “energy self-drivers.”

This isn’t a tech choice—it’s strategic.

When grids aren’t 100% reliable, the only answer is making yourself reliable.

We believe: Energy freedom is core competitiveness in the new industrial era.

From data centers to manufacturing, parks to regional systems, Highstar Sodium is helping global clients build stable, efficient, sustainable energy foundations.

Our promise is simple:

Put energy in enterprise hands.

Energy Independence,

Enterprise Reliability

When power becomes the competitiveness divide,

We help you cross it.